Multimarket contact and target size: The moderating effect of market concentration and location

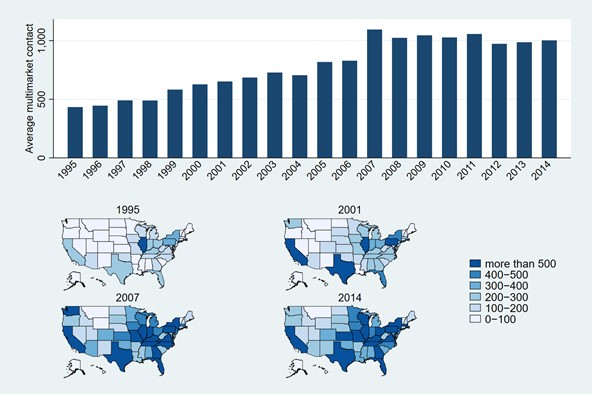

Multimarket contact among large bank holding companies (1995–2014).

Multimarket contact among large bank holding companies (1995–2014).

Abstract

Acquisitions are competitive moves that disrupt an industry’s competitive structure. As a result, firms are often not passive observers of their rival’s acquisitions, but actively retaliate against such competitive moves. In this study, we explore these dynamics by analyzing one way in which multimarket contact may influence acquisition strategies, namely, the type of targets acquired. We contribute to the acquisition literature by clarifying the role that pre-acquisition competitive interdependencies play in firms’ acquisition strategies. Specifically, we suggest that high multimarket contact firms do not necessarily avoid acquisition activity. Instead, these firms are more likely to acquire targets that are less likely to incur retaliation from interconnected rivals. We also explore two important boundary conditions to this relationship: (1) the market’s competitive structure and (2) the location of the target firm. Our empirical tests of a sample of 741 bank holding companies from 1995 to 2014 offer support for our hypotheses.

Supplementary notes can be added here, including code, math, and images.